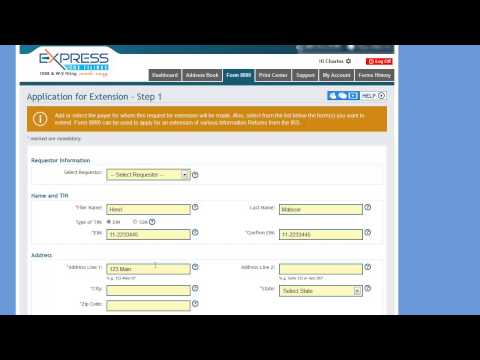

To begin your extension using the form 889, you will need to select the payer for whom this request for an extension will be made from the drop-down menu. Alternatively, you can add the payer's information in the sections provided below the form. The form 889 can be used to apply for an extension of various information returns from the IRS. To move forward, you will need to select the specific forms from the list below that you would like to extend. Once you have made your selections, click "Next" to continue with your form 889.

Award-winning PDF software

8879-s Form: What You Should Know

If the auditor does not determine that you have done anything wrong, the auditor will cancel the audit by giving you the results of the audit within 60 days. (A corporate officer and an ERO using an ERO PIN must file a written acknowledgment of receipt of the auditor's notification of completion of the audit by a corporate officer.) Use of the IRS PIN when you are filing a tax return is not subject to audit. (However, you must file a Statement of Information for your tax return). An ERO that does not intend to use the IRS PIN for a corporate officer, must submit a signed Statement of Information to the IRS (Form ERO-2) before filing this form. The letter should explain the reason for not using the IRS PIN for the following purposes (a listing is not required, but may be helpful to clarify): To make a payment to a third party to obtain goods or services. To obtain credit. To obtain information necessary to provide goods or services. To open a bank account. To obtain a passport. To receive information from you or others under the pretense of business. Taxpayers who use the ERO PIN in any of the above purposes must also provide the ERO PIN to the IRS in a separate letter on form 8879-3 (which can be submitted to the IRS along with Form 8879-S) as evidence of use of the ERO PIN to do any of the purposes listed above. An ERO may make a request to the IRS through the IRS website for approval of an audit of a filing, and may be able to use the IRS PIN to send an electronic communication concerning an audit. The purpose for which the ERO or another employee uses the IRS PIN may be included to facilitate an audit. See IRS Regulations sections 301.6021 Through 301.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8879-PE, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8879-PE online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8879-PE by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8879-PE from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 8879-s